1504-2024

Cam Ranh City develops a digital economy and digital society

1004-2024

The southern real estate market is growing again

0804-2024

The nearly 9,000 billion Cam Lam - Vinh Hao Expressway will open to traffic on April 30

0504-2024

New regulations on Certificate of land use rights that people need to know

0404-2024

More than 1,200 houses are eligible for sale in Khanh Hoa

0304-2024

What will happen to slow investment projects in Binh Thuan?

0104-2024

Handing over the site of Bien Hoa - Vung Tau expressway in June 2024

3003-2024

Chau Duc district promises to be the center of new industrial real estate

2903-2024

The new Land Law will take effect in April 2024

2703-2024

Opinions of the National Assembly on the Nha Trang - Da Lat expressway project

2603-2024

Which bridges will be built by Dong Nai and Ho Chi Minh City?

2503-2024

Dong Nai has a total area of more than 1,000 hectares for social housing

2303-2024

Dat Do district has become a new "target" for real estate investors

2203-2024

Trends in investing in real estate

2103-2024

The ground is of interest

1503-2024

Meeting between the prime minister and large real estate businesses

1403-2024

The opposite scene of the real estate: The South is crowded, the North is deserted

1203-2024

Deputy Prime Minister Tran Hong Ha chaired the meeting with real estate businesses

1203-2024

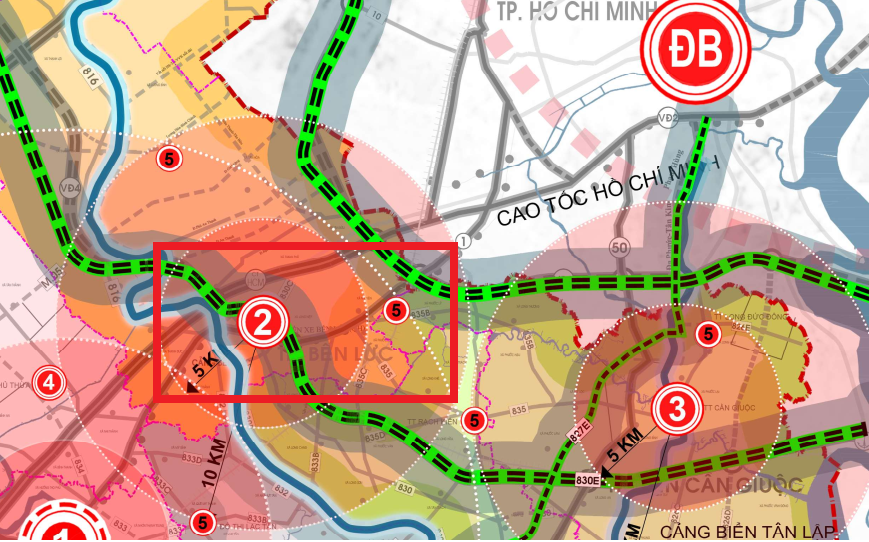

Ho Chi Minh City built a bridge to connect the center with the southern area of the city

0703-2024

Binh Thuan is preparing another large project in Phan Thiet city

2902-2024

What does Long Thanh urban planning have?

2702-2024

In the urban area with a total area of more than 270 hectares, there will be more than 2,000 apartments

2302-2024

The segment that will lead the real estate market in 2024

2002-2024

Support for people whose land will be recovered in 2025

1902-2024

Is it time for this local real estate to explode?

1702-2024

Resort real estate expects change in 2024

1602-2024

Technology "removes difficulties" for the real estate market

0502-2024

Real estate transactions in Ho Chi Minh City are returning

0302-2024

Conditions for issuing Certificate of land use rights in 2024

0102-2024

The new regulations do not limit the rights of buyers

3101-2024

Land Law (amended): What benefits do businesses and people receive?

2901-2024

Binh Thuan starts construction on 3 projects in January 2024

2701-2024

What is the progress of Amata Long Thanh City?

2401-2024

New information about the super project of Dankia - Suoi Vang national tourist area in Lam Dong

2201-2024

Land Law (amended): Reduce procedures, increase local rights

2001-2024

Waterfront City, Aqua City and Nhon Trach New City projects

1901-2024

The final condition for the real estate market to "enter" the growth cycle

1801-2024

Why should Ring Road 4 sections be combined into one large project?

1701-2024

Construction of the Ring Road section in Thu Duc City restarts

1601-2024

How is the coastal road in Phan Thiet doing?

1201-2024

What does Nhon Trach real estate have this year?

1101-2024

What type of real estate will lead the market in 2024?

1001-2024

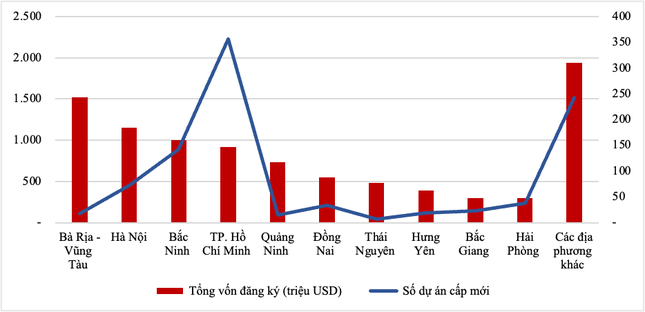

Dong Nai attracts FDI capital flows

0801-2024

Real estate market in 2024

0501-2024

The supply of industrial park land will increase by hundreds of thousands of hectares in 2024

0401-2024

How will Binh Thuan's transport infrastructure be invested in?

0301-2024

How is the expressway located at the gateway of Long Thanh airport?

0201-2024

Two localities of Dong Nai will become towns

3012-2023

Ba Ria - Vung Tau will reclaim more than 500 hectares for 136 projects

2812-2023

Dong Nai announces Land Price Coefficients in 2024

2712-2023

Which real estate will recover the earliest in Dong Nai in 2024?

2612-2023

The real estate market is still difficult in 2024

2512-2023

Many provinces and cities announced plans for the period 2021-2030

2012-2023

Ba Ria - Vung Tau announced planning for the period 2021-2030

1812-2023

A series of real estate projects will be implemented in Lam Dong in 2024

1612-2023

Dong Nai welcomes billion-dollar FDI inflows

1512-2023

My Thuan 2 Bridge and My Thuan - Can Tho Expressway prepare to open to traffic

1412-2023

Real estate sales prices are increasing

1312-2023

How to check land?

1212-2023

The power project invested 1.4 billion USD in Nhon Trach

1112-2023

The lowest price for year-end sales is 2 billion VND/unit

0912-2023

The whole country will have 3,000km of expressways in 2025

0612-2023

Ho Chi Minh City will have 80 wards that must be arranged from now until 2030

0512-2023

The Nha Be and Can Gio bridges are expected to start construction in 2025

0412-2023

Real Estate Business Law has just been passed to tighten the division into plots ground and ground sales

0112-2023

Vietnam's economy in 11 months of 2023

3011-2023

Attract to investment in the Anh Sang Park project in Da Lat city

2911-2023

Housing Law: Does not stipulate the duration of apartment ownership

2811-2023

Should you invest in Nhon Trach real estate now?

2711-2023

Land in Long Dien district has a total of 700 ha that will change the purpose of use in 2024

2511-2023

Nhon Trach becomes a satellite urban area in Ho Chi Minh City that meets class II urban standards by 2030

2411-2023

The bridge connects between Ho Chi Minh City, Dong Nai province

2311-2023

Hot: The Government removes difficulties for Novaland's project and other projects in Dong Nai

2211-2023

Buying a house is still better than renting a house

1711-2023

Chairman of the National Assembly: The revised Land Law has not been approved at this session

1311-2023

Da Lat City's land use planning until 2030 was approved by Lam Dong

1011-2023

The hundred billion bridge on the arterial road is about to open to traffic

0811-2023

Two urban areas with a total area of 1,000 hectares have just been approved in Dong Nai

0711-2023

Which districts and communes in Dong Nai must be arranged, and what will the roadmap be?

0611-2023

The real estate market begins a growth cycle

3010-2023

From October 16, 2023, there will be many changes to people's certificates of land use rights

2810-2023

The tallest and most unique 108-storey financial tower in Dong Anh will start construction in the next 14 days

2710-2023

“The real estate market will be brilliant from 2025, investors can take profits in 2026”

2610-2023

3 signs that the best real estate investment opportunity is today

2510-2023

What did the Deputy Minister of Construction say about the Cam Lam Urban General Planning project?

2310-2023

The real estate market prepares to welcome thousands of supplies of all types

1810-2023

Industrial real estate has transactions of hundreds of billions of dollars, "revealing" the leading area

1710-2023

Experts predict that the real estate market will recover the fastest

1610-2023

Is the real estate market about to have lots of new good news?

1410-2023

The Prime Minister requested to submit a decree on land prices before October 25

1310-2023

What's special about the newly approved planning of Binh Thuan province?

1210-2023

Binh Thuan: Suitable for investors

1010-2023

Rich people started buying adjacent villas

0610-2023

What areas should you pay attention to when buying and selling land in Lam Dong?

0510-2023

Lam Dong starts construction on the expressway at the end of 2023

0410-2023

What do experts say about the potential of the real estate market in Ba Ria - Vung Tau?

0310-2023

Binh Thuan is preparing to start construction of an industrial park of nearly 300 hectares, with a total investment capital of 1,200 billion VND

0210-2023

After 9 months, Vietnam's economy has received many positive signals

3009-2023

Predicting risk by real estate experts from now until 2024

2809-2023

Latest regulations on Spit the land plot in Ba Ria - Vung Tau

2209-2023

Urban development in Duc Linh Binh Thuan combines industry

1909-2023

"Maybe lose opportunities when real estate prices are good”

1809-2023

When the neighbor does not sign the land border to make a Certificate of land use rights, how to solve the problem?

1609-2023

There is a "T" symbol on Certificates of land use rights, what does that mean?

1509-2023

The land development again may occur in the period from 2025 to 2026 according to VNDirect

1409-2023

Director of the Ministry of Construction: Real estate prices will increase at the end of the year and increase again in 2024.

0809-2023

Foundation Soil prices are about to return?

0709-2023

The expert explains how to best value land based on the current market

3108-2023

Is the real estate market ready to welcome a return?

3008-2023

Approved investment in Binh Thuan's almost 500-hectare industrial zone

2808-2023

Regulations on issuance of Certificate of land use rights before July 1, 2004 without paper

2508-2023

New capital flows strongly into the industrial real estate market

2408-2023

Nhon Trach to the city: Expectation to become an extension arm of HCM city

2308-2023

It is forecasted that the real estate market will have to wait until 2024-2026 to recover

2208-2023

Binh Thuan continuously issued documents to solve difficult problems for projects and investors

2108-2023

Real estate market: Forecast to recover by year-end

1808-2023

Three signals are forecasted that the real estate market will recover in the second half of 2024

1708-2023

24h Real Estate: Progress of important infrastructure projects in Dong Nai

1608-2023

Binh Thuan is piloting night economic activities at NovaWorld Phan Thiet and Thanh Long Bay projects

1508-2023

Which agency provides land data and how to request?

1408-2023

The real estate market in the South has recovered clearly and will continue in the near future

1208-2023

The General Manager of BHS Group told the story of buying real estate for 0 dong in cash and a profit of 800 million dong after 6 months

1108-2023

"Super project" of a tourist area of nearly 4,000 hectares in Lam Dong

1008-2023

Will Khanh Hoa merge a number of commune-level administrative units in Ninh Hoa town and Van Ninh district?

0908-2023

The government continuously removes difficulties for real estate, many positive forecasts for the market in the last 6 months of the year

0808-2023

Binh Thuan received information about the $5 billion NovaWorld Phan Thiet project to be removed

0708-2023

The route to the city of Nhon Trach, Long Thanh

0408-2023

Real estate shows positive signs, the second quarter is less difficult than the first quarter and will be better in the coming time

0208-2023

Before 2030, will Long Thanh and Nhon Trach become cities?

2707-2023

The rich still invest tens of billions in homestay investment: "If you know how to do business, you will recover your capital after 2 years"

2507-2023

24h real estate: Proposed investment in coastal road connecting Ho Chi Minh City to the West

2407-2023

The urban resort complex planning sponsored by Novaland has been accepted by Lam Dong.

2207-2023

To issue a decision to reduce 30% of 2023 land rent in July 2023 in Vietnam

2007-2023

It is expected that the expressway in the Southeast with a total length of 126km is about to be started

1907-2023

Unpacking for large cities in the Southeast region, promoting transport infrastructure for satellite cities

1807-2023

Real estate and new signals

1707-2023

Lam Dong plans to attract a series of Vingroup, Sungroup, Hung Thinh, Him Lam, Sovico, Bitexco, Becamex... to invest in the province.

1507-2023

Real estate market in the second half of 2023

1407-2023

Merger of a series of administrative units of districts and communes of Lam Dong province

1307-2023

Change the purpose of land use, separate the land plot in Lam Dong

1207-2023

Lien Khuong Airport becomes an international airport in Lam Dong

1107-2023

Chinese and Singaporean enterprises continuously pour capital, and a province has exceeded the investment target in just 6 months

0807-2023

24h Real Estate: Dong Nai prepares to have 7 more provincial roads

0707-2023

Nhon Trach district (Dong Nai) will become a city

0607-2023

Fines and compensation for building houses that affect neighbors' houses

0407-2023

A real estate segment in Ho Chi Minh City appeared, thereby showing signs of recovery

2706-2023

From June 20, the locality can decide the area to subdivide and sell plots, without consulting the Ministry of Construction?

2606-2023

The Minister of Construction affirmed that real estate transactions through the trading floor do not increase the selling price

2206-2023

Real estate in the suburbs - attracting investors

2006-2023

Bao Loc Real Estate is facing new development opportunities

1906-2023

Supply only accounts for 30% of real demand, this segment is extremely attractive to private enterprises

1706-2023

Revealing the list of enterprises winning the largest highway construction contract

1606-2023

Planning of Tan An city become a satellite urban of Ho Chi Minh City

1406-2023

VND 1,000 billion coastal road is delayed due to titanium mine

1306-2023

Ba Ria - Vung Tau coastal road in the future

1206-2023

Suggest to merge some districts and communes in Lam Dong province

0806-2023

Real estate transactions in Lam Dong show signs of increasing again

0706-2023

24h Real estate : Consider expanding the Ho Chi Minh City - Trung Luong expressway to 10 lanes

0306-2023

Lam Dong needs more land to implement many big projects

0106-2023

Dong Nai wants to auction 36 land plots of nearly 800 billion VND

3105-2023

When will real estate liquidity return?

3005-2023

4 things to choose for a real estate location

2505-2023

24H Real Estate: Location, area 66 social housing projects in Dong Nai

2405-2023

Lam Dong: Two documents related to parcel separation and consolidation

2305-2023

Forecasting developments in resort real estate mergers and acquisitions in the next few quarters

2205-2023

How to know if the land plot in use is eligible for a Certificate of land use rights?

1805-2023

Long Thanh district organized a scientific workshop to comment on the Dong Nai Provincial Planning for the period of 2021-2030, and a vision to 2050

1805-2023

Binh Thuan resort real estate benefits from infrastructure

1605-2023

Binh Thuan welcomes a series of good news, prepares for a new growth cycle

1305-2023

Lam Dong plans to make many important plans to make a big impact on the real estate market

0505-2023

6 coastal urban areas will be developed and formed in Ninh Thuan

0405-2023

What will the real estate market look like in the second half of 2023?

2804-2023

Three things to keep in mind when traveling on the Phan Thiet - Dau Giay expressway

2504-2023

Real estate market receive positive signals at the end of Q2

2404-2023

A big change in the issuance certificate of land use rights

2204-2023

Proposal to tax real estate ownership and inheritance to reduce home prices.

2104-2023

Despite the quiet overall market, the commercial real estate segment continues to increase in price

1804-2023

Nearly 16,000 billion in investment sources for railways in the period of 2021-2025

1704-2023

There are 4 reasons why long-term real estate investors always win

1404-2023

Vietnam is the most sought after real estate market in the region

1304-2023

Real estate broker: After half a year, there are continuous transactions; There are three to four houses priced at tens of billions of dong each sold every day.

1204-2023

Prime Minister asked to reduce procedures in land transactions

1104-2023

A real estate segment is said to "surmount the crisis"

1004-2023

The price of land plots in Binh Thuan has skyrocketed

0804-2023

Agricultural land recovery can be compensated with houses or apartments: Deputy Prime Minister Tran Hong Ha

0704-2023

Will the removal of legal regulations help resort real estate come out of hibernation?

0404-2023

Long-term investors have opportunities when the market changes

0304-2023

Why is real estate still an investment option in unstable economic times?

0104-2023

What is the goal of the wave of real estate investment?

3103-2023

A number of large investment projects that will be implemented in Khanh Hoa in the near future have been revealed.

3003-2023

March 29: 57/63 provinces and cities shared land data, does it help solve "ghost projects"?

2903-2023

When the 1,000 billion VND road is completed, Khanh Hoa will invest an additional 3,000 billion VND in coastal roads for Van Phong Economic Zone.

2803-2023

Which cases will not be issued Certificate of Land Use Rights?

2503-2023

Binh Duong and Ho Chi Minh City invested 5,300 billion VND in Di An - Thu Duc city

2303-2023

The Prime Minister proposed the participation of American companies in the Long Thanh Airport project.

2203-2023

The real estate market will begin to have opportunities from mid-2023

2103-2023

what direction will the expansion planning in Da Lat city change?

2003-2023

Binh Chanh agricultural land is compensated at a maximum of 38 times price more than the State price

1803-2023

Binh Duong province planning period 2021-2030: Set aside 2,000 hectares for urban and service development for Thuan An and Di An

1703-2023

Secretary of Dong Nai contacted people whose land was recovered to build two roads connecting Long Thanh airport

1603-2023

Will there be an increase in peri-urban land prices in Hanoi?

1503-2023

What is the current progress of 9 projects in the Lam Dong real estate market?

1403-2023

Should the issuance of a Certificate of land use rights be expanded by handwriting?

1303-2023

In 2023 there will be a reduction in real estate loan interest rates

1103-2023

Many important plans are about to be approved in 2023 that will boost the real estate market

0703-2023

What types of real estate taxes are expected to change in the near future?

0603-2023

Ho Chi Minh City will remove bottlenecks for the development of the real estate market in March

0303-2023

Capital and interest rate solutions to solve difficulties for real estate

0103-2023

Nhon Trach will be an industrial urban area - a port city

2202-2023

What is NKH land? Can I build a house on NKH land?

1702-2023

How to look up Certificate of Land Use Rights information online?

1502-2023

A new wave of investment will land in Khanh Hoa in 2023

1402-2023

Organize to collect people's opinions on the draft Land Law (amended)

1302-2023

18 apartment projects are expected to open for sale in 2023

1002-2023

What did real estate businesses propose in the meeting with the State Bank?

0902-2023

The State Bank is meeting with real estate businesses

0802-2023

What is real estate looking forward to in 2023?

0602-2023

The real estate meeting will take place in February

0302-2023

What does Ninh Thuan make in the housing development program for the period 2021 - 2025?

3101-2023

Existing real estate is only in the apartment, luxury housing, and tourism real estate segments

3001-2023

Why should you invest in real estate?

2701-2023

'Hot spots' have a big impact on the real estate market in 2023

1901-2023

In 2023, Chinese real estate will recover step by step

1801-2023

The land fund of more than 370 hectares is expected to be auctioned by Lam Dong in 2023

1701-2023

Investing in the Khanh Hoa - Lam Dong - Dak Lak expressway project

1401-2023

Tourism real estate prices still increase

1301-2023

2 major roads in An Giang cost 1,600 billion VND

1201-2023

Mobilized interest rates are expected to increase slowly

1101-2023

Ho Chi Minh City has proposed the scale of Cat Lai bridge as well as the construction of two additional bridges connecting with Dong Nai.

1001-2023

The apartment market is expected to be good in mid-2023

0901-2023

January 7: Steel coil prices increased simultaneously

0701-2023

17 expressways start to construct in 2023

0401-2023

The estimated investment is nearly 730,000 billion VND in 2023

0301-2023

Expect cash flow to return in 2023

3112-2022

Why do luxury real estate located in the central area still attract investors?

3012-2022

When will real estate return?

2912-2022

5 potential signs of real estate

2712-2022

Real estate prices will increase again in 2023

2712-2022

When will the new urban planning project of Cam Lam, Khanh Hoa be completed?

2312-2022

Da Nang spends nearly 3,000 billion VND on 2 traffic projects in 2023

1910-2022

Ho Chi Minh City is looking for a new location to build a bridge connecting Dong Nai

0909-2022

Is loosening credit room a "magic wand" for the real estate market?

-660a434c892cc.png)

-6600e09b877b9.jpg)

-65b46d8a62703.png)

-6563e9d55e804.png)

-6556c28e76ce7.jpg)

-654ae08084871.jpg)

-6548445e5171c.jpg)

-6535d768e0cd5.jpg)

-652f3d92ee83c.jpg)

-652df0cadaa89.jpg)

-652a031fcc67d.jpg)

-6524a1949473b.jpg)

-651e0d593c6ea.jpg)

-650ce7e86f00a.jpg)

-6508f22a998a5.jpg)

-6503ad09b77e1.jpg)

-65025c9370a75.jpg)

-64fa7245e6898.jpg)

-64e6b867d759f.jpg)

-64e55c8720879.jpg)

-64dc20136bba8.jpg)

-64d97dad4b818.jpg)

-64bb258ce76ec.jpg)

-64b5e3293af70.jpg)

-64b4929d7ce37.jpg)

-6477ed445d2e0.jpg)

-6441df1e66357.jpg)

-643506f350115.jpg)

-6430bb1b57e77.jpg)

-6424e3dd43059.jpg)

-6420e8d2000bd.png)

-641e44de2a487.jpg)

-638d4e557f82a.png)

-638955a7b54cf.jpg)

-6386d4f7a6908.jpg)

-637d740b8d16d.jpg)

-637ae07859320.png)

-636ef4848c57c.jpg)

-63607127bc51c.jpg)

-634dfc74b7c3b.png)

-6317f5f9a07c8.png)

-63154795dddb0.jpg)

-62f99c9995a7a.jpg)

-62e32e292628f.jpg)

-62ddeec965dc2.png)

-62280950b7cb0.jpg)